Table of Contents

- Bond Market - Road Sign Illustration | CartoonDealer.com #168479581

- Business Insider: A bond market insider explains why the market is ...

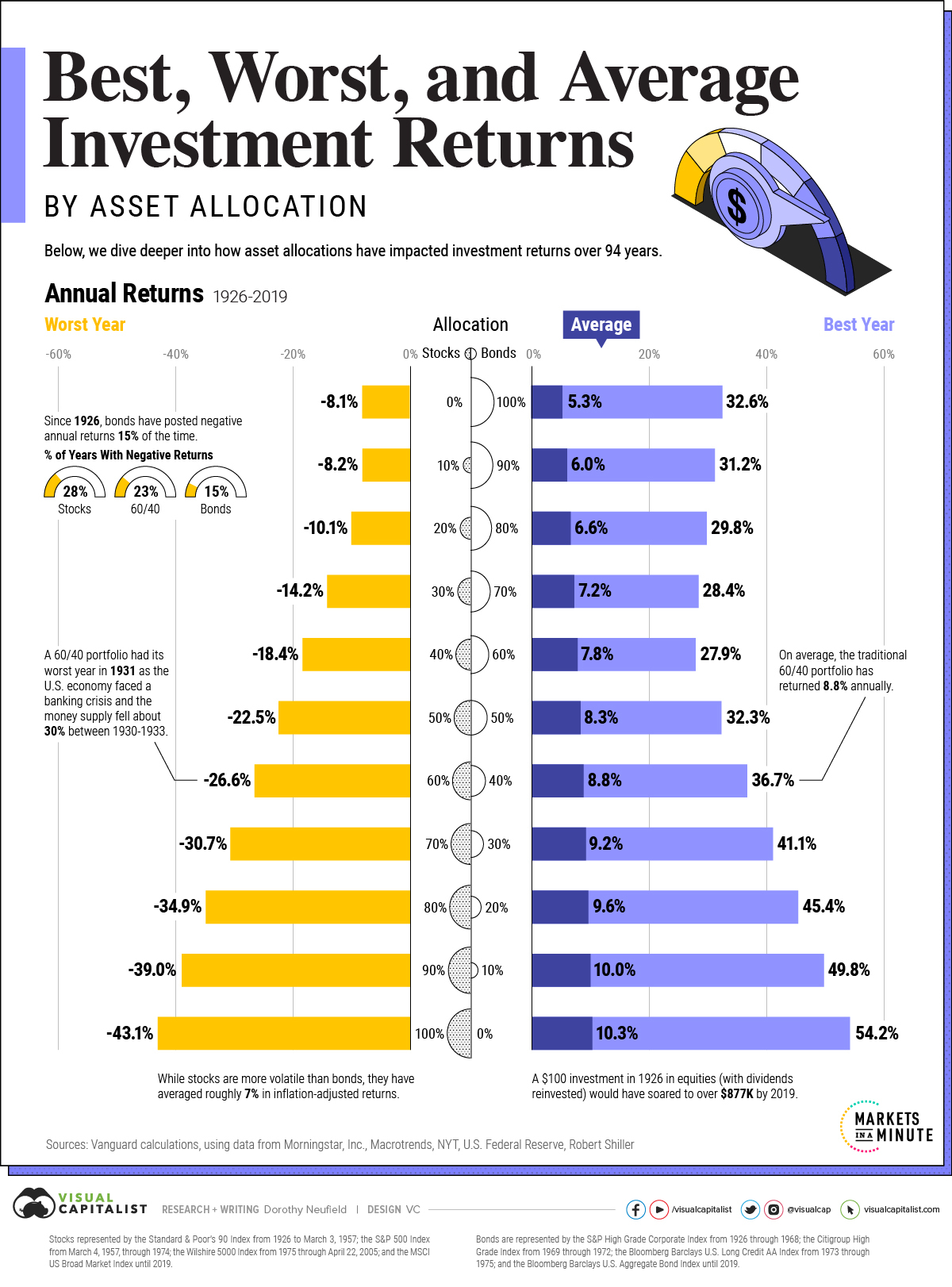

- Visualizing 90 Years of Stock and Bond Portfolio Performance - City ...

- Raj Times and Cycles: Did we see a major Interest Rate Bottom and Bond ...

- What’s the Deal with Surging Bond Yields? | J.P. Morgan

- India's bond market norms: How they have evolved over the last decade

- Key bond market deals: Sundaram Finance, GMR Airports, NLC India

- Bond Market In 2024 - Tildi Gilberte

- How Bonds Are Priced

- What Investors Should Know About Bonds | Investing | US News

What are US Treasury Bonds?

/GettyImages-81897180-b091a34e0f4e4bcd888f5023d4cc1d31.jpg)

US Treasury Bond Prices

The prices of US Treasury bonds are determined by market forces, reflecting the interactions of supply and demand in the bond market. When demand for Treasury bonds increases, prices tend to rise, and yields decline. Conversely, when demand decreases, prices fall, and yields increase. The prices of US Treasury bonds are influenced by various factors, including: Interest rates Inflation expectations Economic growth Geopolitical events Central bank policies

Changes in US Treasury Bond Prices

The prices of US Treasury bonds can fluctuate significantly over time, reflecting changes in market conditions and investor sentiment. For example, during times of economic uncertainty, investors may flock to Treasury bonds as a safe-haven asset, driving up prices and pushing yields lower. Conversely, during periods of economic growth, investors may become more risk-tolerant, leading to a decline in demand for Treasury bonds and a subsequent decrease in prices.

Trading Volume of US Treasury Bonds

The trading volume of US Treasury bonds is a critical indicator of market activity and liquidity. The most actively traded Treasury bonds are typically the 10-year and 30-year bonds, which are widely used as benchmarks for the overall bond market. The trading volume of US Treasury bonds can be influenced by various factors, including: Economic data releases Central bank announcements Geopolitical events Market sentiment